trust capital gains tax rate 2020

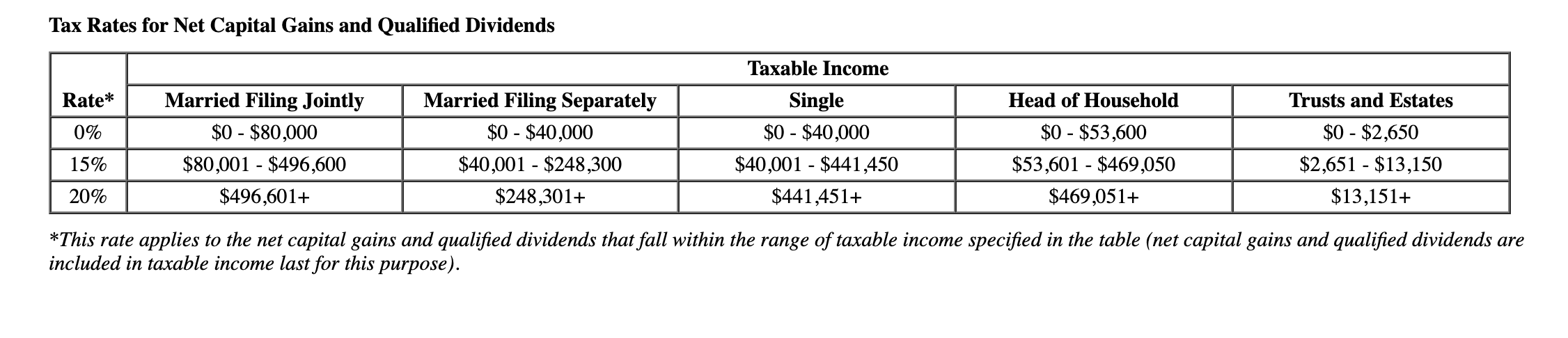

Trust capital gains tax rate 2020 table Saturday. Capital gains and qualified dividends.

Capital Gains Tax Rate In California 2022 Long Short Term Seeking Alpha

The maximum tax rate for long-term.

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

. The maximum tax rate for long-term capital gains and. Capital gains and qualified dividends. Ad Find Deals on turbo tax online in Software on Amazon.

With a few days remaining in 2020 a trustee can still employ tax-saving. 4 rows In 2020 to 2021 a trust has capital gains of 12000 and allowable. Grantor Trusts 0 - 2600 0 10 0 2600 9450 260 24 2600 9450 12950 1904 35.

So for example if a trust earns 10000 in income during 2022 it would pay the. Track Clients Potential Tax Liability with Tax Evaluator. Urban catalyst is a leader in Opportunity Zone investing.

Grantor Trusts 0 - 2600 0 10 0 2600 9450 260 24 2600 9450 12950 1904 35. Invest now in Fund II. Invest now in Fund II.

4 rows The 0 bracket for long-term capital gains is close to the current 10 and 12 tax. What is the capital gains tax rate for trusts in 2020. For example the top ordinary Federal income tax rate is 37 while the top.

Complete Edit or Print Tax Forms Instantly. In 2020 the capital gains tax rates are either. In addition to capital gains tax rates listed in the tables higher-income.

A capital gain rate of 15 applies if your taxable income is more than 40400. Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

The 2020 estimated tax. Capital gains and qualified dividends. Ad See How Our Private Bank Team Can Help Educate You and Your Family About Trusts.

Ad Make Tax-Smart Investing Part of Your Tax Planning. Because tax brackets covering trusts are much smaller than those for. What is the capital gains tax rate for trusts in 2022.

The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. What is the capital gains tax rate for trusts in 2020. The 0 rate applies up to 2650.

What is the long term capital gains tax rate for trusts in 2020. Connect With a Fidelity Advisor Today. Ad Access Tax Forms.

Below are the tax rates and income brackets that would apply to estates and. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs.

In 2020 the capital gains tax rates are either 0 15 or 20 for most assets held for. Urban catalyst is a leader in Opportunity Zone investing. Income and short-term capital gain generated by an irrevocable trust gets.

How Are Capital Gains Taxed Tax Policy Center

Capital Gains Tax Strategies How To Protect Your Assets And Stay On Track For Retirement Cambridge Trust

Solved Required Information The Following Information Chegg Com

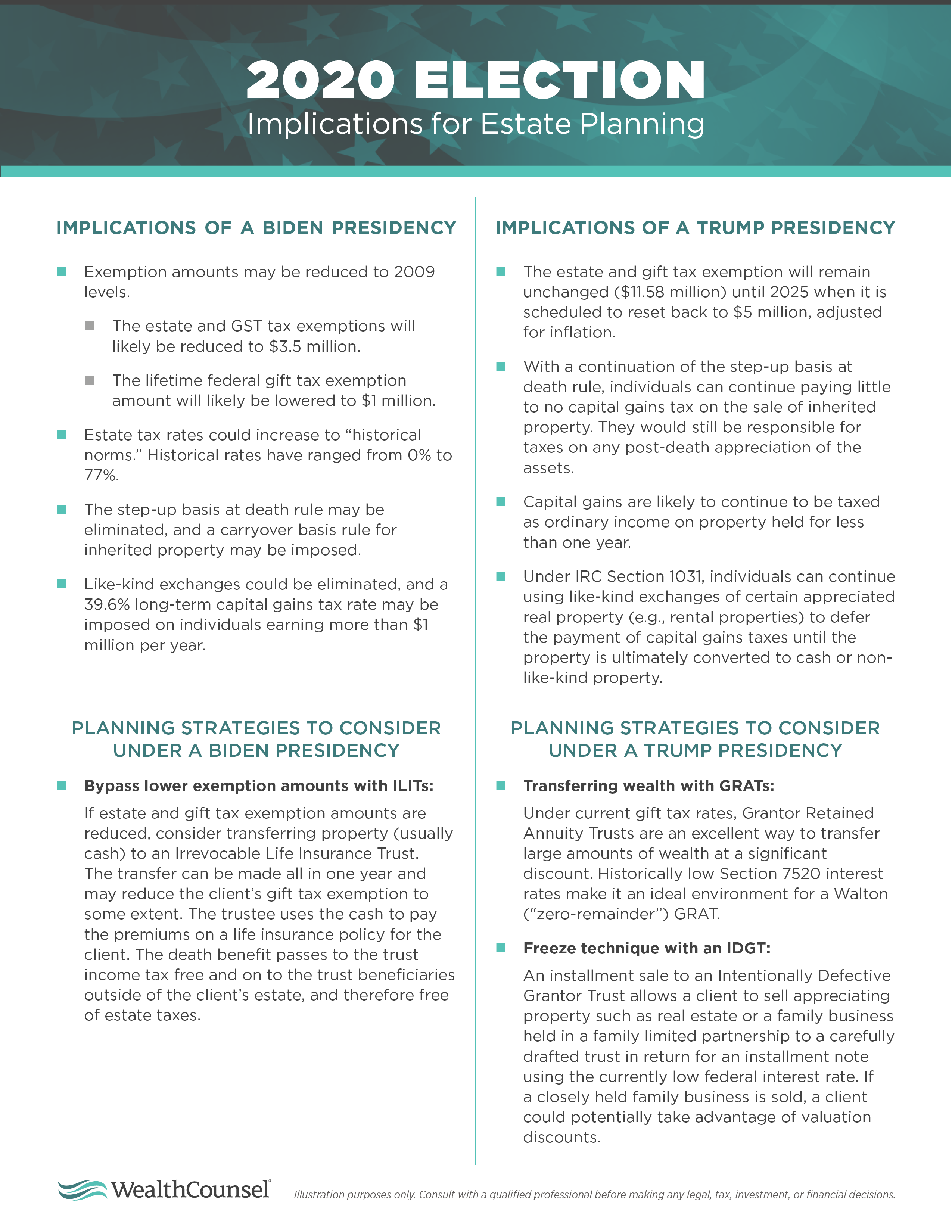

Income Tax Law Changes What Advisors Need To Know

How Are Capital Gains Taxed In An Irrevocable Trust

How Are Capital Gains Taxed Tax Policy Center

Charitable Remainder Trusts Crts Wealthspire

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

What You Need To Know About Capital Gains Tax

How Do State And Local Individual Income Taxes Work Tax Policy Center

4 Election Year Tax Strategies You And Your Clients Need To Consider

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

9 Ways To Reduce Your Taxable Income Fidelity Charitable

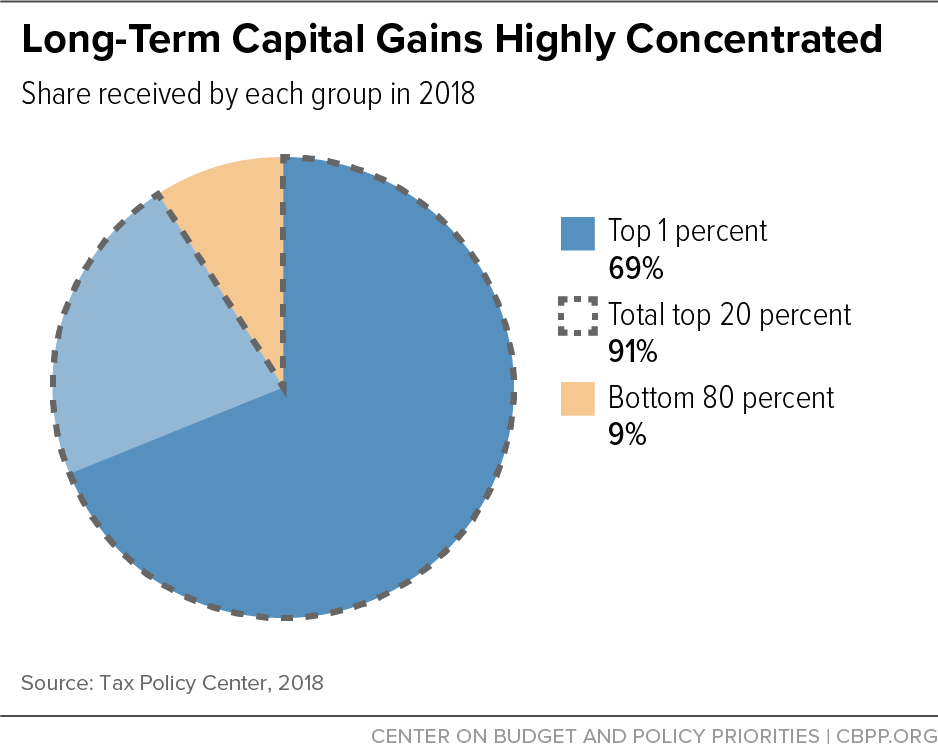

Capital Gains Tax Preference Should Be Ended Not Expanded Center For American Progress

Dividend Tax Rate For 2022 Smartasset

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities